What Is a Capital Appreciation Bond?

/This content was originally published by Keygent Managing Member, Chet Wang.

A capital appreciation bond (“CAB”) differs from current interest bonds in 3 primary ways:

Instead of paying semiannual interest, no interest is paid until the final maturity

the interest is compounded (or accreted) and

the interest rates are typically higher (to compensate investors for not receiving regular interest payments).

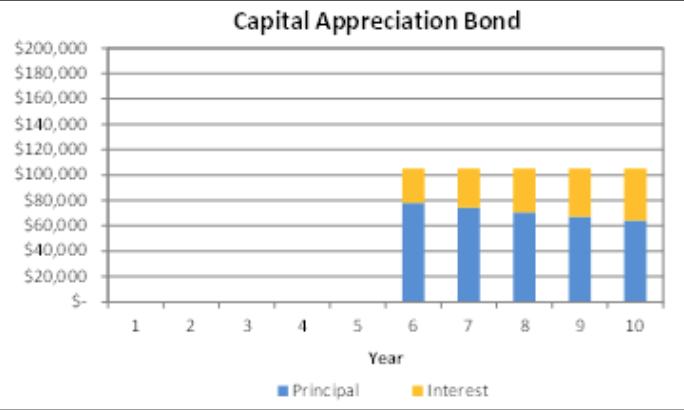

The following is an example of a $100,000 principal amount that matures in 10 years

In this illustration, you can see that no regular interest payments are made, and that the interest is due at the same time as the principal.

CABs have been the subject of much discussion given their higher cost relative to current interest bonds

A common misconception of CABs is that it’s a balloon payment whereas current interest bonds are not. This is not always true as a current interest bond could also have one large principal payment due out in the future.

Similar to current interest bonds, CAB maturities could be structured such that principal is amortized more regularly, as illustrated below.

CABs are typically utilized when there is little to no capacity to pay the regular interest payments.