Keygent provides strategic and technical municipal advisory services to California school and community college districts.

Expert Guidance

Our distinguishing characteristic is our rigorous quantitative approach, including financial modeling, interest rate analysis, and bond pricing expertise. This knowledge allows us to present multiple financing options for every situation.

Exclusive Focus on California Education

Keygent is a California-based firm serving only California K-14 districts. We neither serve out-of-State issuers nor non-educational entities. This specialization gives us a deep understanding of the nuances in California education bonds.

Independent Municipal Advisory Firm

Keygent serves solely as an independent municipal advisor. We don’t act as broker-dealers or underwriters, who may have competing financial or other interests. As your fiduciary, our responsibility is to put our client’s best interests first.

Certified Minority Business Enterprise

Keygent is certified by the California Department of Transportation as a State Minority Business Enterprise. Firm number: 37162.

Keygent’s Recent Financings

Selma Unified School District

Election of 2022 General Obligation Bonds, Series B

Par Amount: $13,000,000

County: Fresno

Official Statement

Whittier Union High School District

Election of 2020 General Obligation Bonds, Series C

Par Amount: $45,875,000

County: Los Angeles

Official Statement

Palo Alto Unified School District

General Obligation Bonds (Election of 2018), Series 2025

Par Amount: $190,000,000

County: Santa Clara

Official Statement

San Mateo Union High School District

Election of 2020 General Obligation Bonds, Series D

Par Amount: $96,250,000

County: San Mateo

Official Statement

Clovis Unified School District

2025 Refunding General Obligation Bonds

Par Amount: $9,195,000

County: Fresno

Official Statement

Clovis Unified School District

General Obligation Bonds Election of 2024, Series A

Par Amount: $125,000,000

County: Fresno

Official Statement

Fresno Unified School District

2025 Refunding General Obligation Bonds, Series B (Federally Taxable)

Par Amount: $10,735,000

County: Fresno

Official Statement

Fresno Unified School District

2025 Refunding General Obligation Bonds, Series A (Tax-Exempt)

Par Amount: $4,255,000

County: Fresno

Official Statement

Fresno Unified School District

General Obligation Bonds Election of 2024, Series A (Tax-Exempt)

Par Amount: $30,000,000

County: Fresno

Official Statement

Beverly Hills Unified School District

2025 General Obligation Refunding Bonds

Par Amount: $31,055,000

County: Los Angeles

Official Statement

South Monterey County Joint Union High School District

Election of 2024 General Obligation Bonds, Series A-1 (Measure I)

Par Amount: $15,000,000

Counties: Monterey & San Benito

Official Statement

South Monterey County Joint Union High School District

Election of 2024 General Obligation Bonds, Series A (Measure H)

Par Amount: $15,000,000

Counties: Monterey & San Benito

Official Statement

Salinas Union High School District

Election of 2024 General Obligation Bonds, Series A

Par Amount: $30,000,000

County: Monterey

Official Statement

Salinas Union High School District

Election of 2020 General Obligation Bonds, Series B

Par Amount: $70,000,000

County: Monterey

Official Statement

Salinas Union High School District

Election of 2002 General Obligation Bonds, Series B (MSFID)

Par Amount: $8,500,000

County: Monterey

Official Statement

San Mateo-Foster City School District

Election of 2020 General Obligation Bonds, Series C

Par Amount: $100,000,000

County: San Mateo

Official Statement

San Bernardino Community College District

2025 General Obligation Refunding Bonds

Par Amount: $12,620,000

Counties: San Bernardino & Riverside

Official Statement

San Bernardino Community College District

Election of 2008 General Obligation Bonds, Series F

Par Amount: $153,146,339.05

Counties: San Bernardino & Riverside

Official Statement

Centinela Valley Union School District

2024 Election General Obligation Bonds, 2025 Series A (SFID No. 2016-1 of the LPSFA)

Par Amount: $55,000,000

County: Los Angeles

Official Statement

Firebaugh-Las Deltas Unified School District

Election of 2024 General Obligation Bonds, Series A

Par Amount: $15,000,000

Counties: Fresno & Madera

Official Statement

Sanger Unified School District

General Obligation Bonds Election of 2024, Series A

Par Amount: $30,000,000

County: Fresno

Official Statement

Hartnell Community College District

Election of 2016 General Obligation Bonds, Series C

Par Amount: $27,000,000

Counties: Monterey & San Benito

Official Statement

Foothill-De Anza Community College District

Election of 2020 General Obligation Bonds, Series D

Par Amount: $151,000,000

County: Santa Clara

Official Statement

Twin Rivers Unified School District

General Obligation Bonds 2022 Election, Series B (Elementary SFID)

Par Amount: $55,000,000

Counties: Sacramento & Placer

Official Statement

Twin Rivers Unified School District

General Obligation Bonds 2022 Election, Series B

Par Amount: $40,000,000

Counties: Sacramento & Placer

Official Statement

Twin Rivers Unified School District

General Obligation Bonds 2006 Election, Series F

Par Amount: $3,970,000

Counties: Sacramento & Placer

Official Statement

San Marino Unified School District

General Obligation Bonds, 2024 Election, 2025 Series A

Par Amount: $40,000,000

County: Los Angeles

Official Statement

Roseville Joint Union High School District

Election of 2007 General Obligation Bonds, Series E (SFID No. 1)

Par Amount: $50,986,233.10

County: Placer

Official Statement

Anaheim Union High School District

Election of 2024 General Obligation Bonds, Series A-1 (Federally Taxable)

Par Amount: $27,250,000

County: Orange

Official Statement

Anaheim Union High School District

Election of 2024 General Obligation Bonds, Series A (Tax-Exempt)

Par Amount: $180,000,000

County: Orange

Official Statement

Explore Our Content

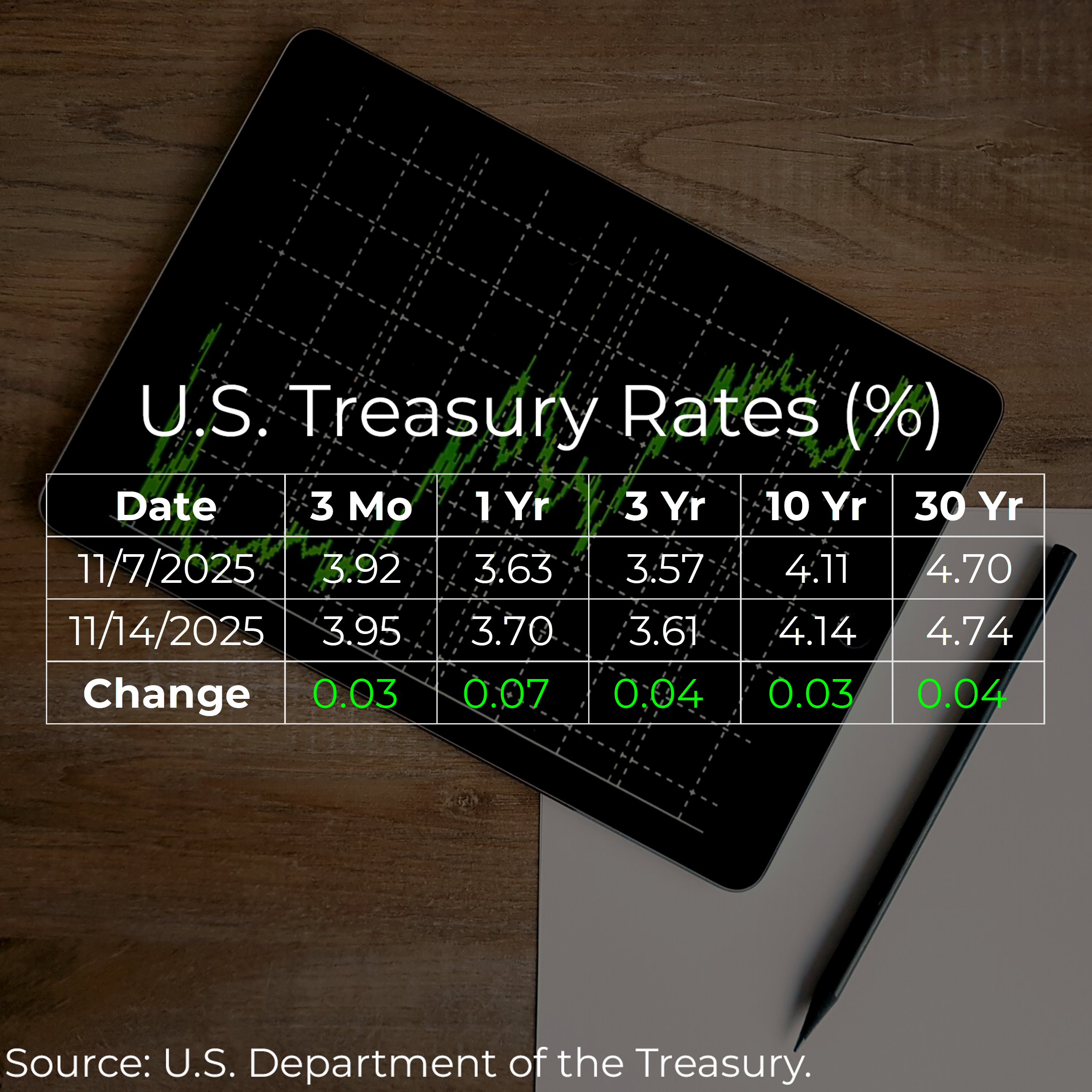

A majority of short-term U.S. treasury rates decreased, while a majority of long-term rates increased this week.